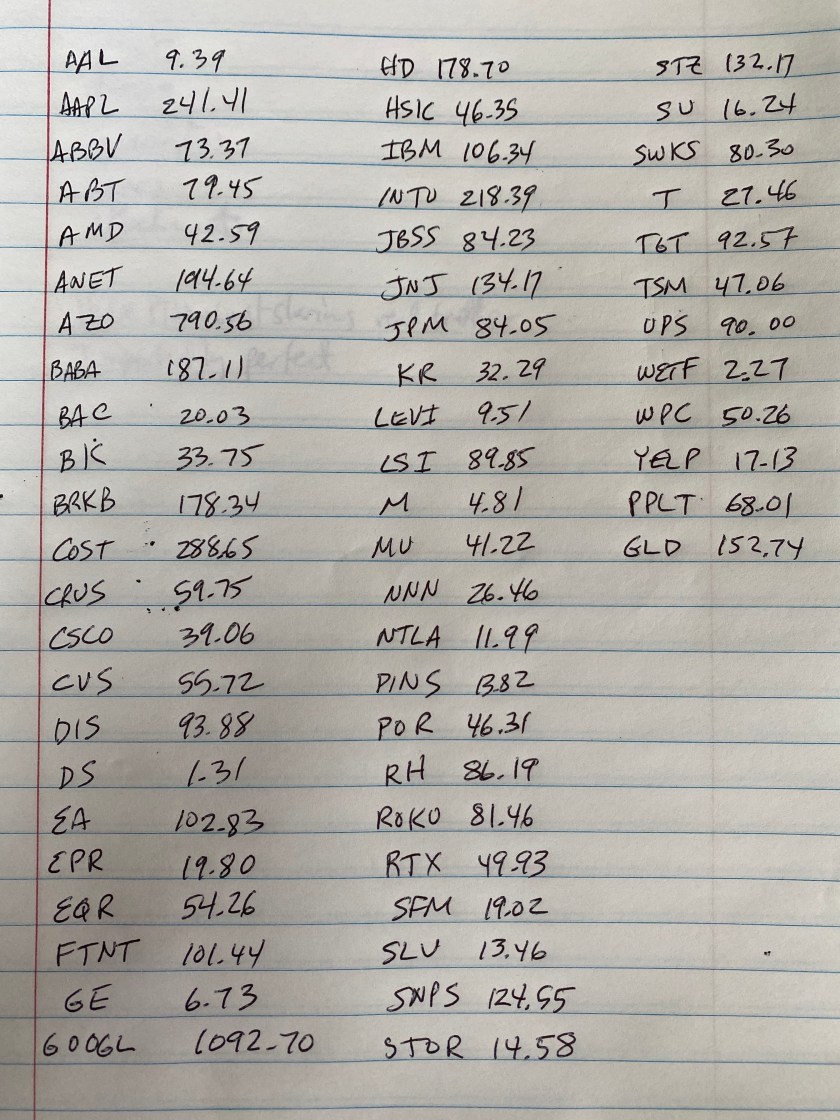

My brother asked me for stock picks for Monday and this is the list I gave him, with prices as of the end of the day last Friday, April 3rd. Once the U.S. makes it past June 8th, the following stocks should, as a group, be a diversified portfolio that will beat the performance of the SP500 (SPY=248.19, S&P=2488.65). I plan to track them from here until June 8th, and until the end of the year.

I noticed the post yesterday has the wrong day of the week (0402F). It should have been “0402h”. I’m sure the fact that I wrote it on Friday contributed to this mistake. But, it could also be explained by universes colliding. I hope to get back to posting every day, at least until day 160 of this year, June 8th, by which time I hope to be back in a universe in which I’m rarely thinking about or posting about coronaviruses or pandemics.

Today I experienced merging back into a universe I was in a week or so ago. Before the California shelter-in-place order for Santa Cruz County, I had planned to rent a room in a community house. Then, when the initial order was until April 7th, I delayed my move in until that date. Later, when the initial order was extended until May 3rd, I decided to stay where I am until the end of April. However, after feeling into the different universes, I feeling a stronger alignment with the universe where I move in April 7th. I spoke with the owner of the house this morning, and now plan to move in on that date. I wonder if this will pull closer to me universes where the Santa Cruz County shelter-in-place order ends earlier than May 3rd, or at least doesn’t get extended longer.

Some other sets of universes merging this weekend are:

- Universes where hydroxychloroquine is or is not part of the treatment for COVID-19 patients (Ref: https://www.cnn.com/2020/04/05/politics/white-house-malaria-drug-hydroxychloroquine-disagreement/index.html);

- Tigers at US zoo test positive for SARS-CoV-2, bringing us closer to the universes in which COVID-19 is spread via pets;

- Japan has not yet, but may, declare a state of emergency due to COVID-19; and

- The US has COVID-19 outbreaks under control or not – Dr. Fauci says the US doesn’t and is instead struggling.