Santa Cruz, CA: Last week the stock market had a good week – one of the best in quite a while. A few days ago I spoke to a friend from the future who is betting against the market. She is not alone. I just googled “hedge fund bets on sell off” and found the following – interesting from Nov. 22, 2019!

Ray Dalio replied to the WSJ by posting that it is misleading to report that he had a bearish view of the stock market and that his hedge fund, Bridgewater Associates, had no “net bet” that the stock market would fall. What seems clear is that he was hedging his stock portfolio to protect it from a drop in the overall market.

So, Ray was apparently feeling the recent market plunge back in October of last year and started buying “insurance” against a total market correction. It would require delving into conspiracy theories to ponder the reasons why he felt the need for such insurance. Perhaps he took notice of the Event 201 Pandemic Simulation Exercise. From the website:

Event 201, hosted by the Johns Hopkins Center for Health Security, envisions a fast-spreading coronavirus with a devastating impact

In an article from almost a month ago, Bridgewater has placed even bigger bets – $15B against Europe and UK. From the article:

The world’s biggest hedge fund manager’s short positions amount to more than $5.3 billion in France and $4.7 billion in Germany, while in Spain its shorts add up to almost $1.4 billion and $821 million in three Italian companies.

…

Data was not available to show whether Bridgewater, which has $160 billion in assets under management, holds more European stocks than it shorts.

Another hedge fund manager, Bill Ackman, posted about a 100x return on his company’s website:

On 23 March, we completed the exit of our hedges generating proceeds of $2.6bn for the Pershing Square funds, compared with premiums paid and commissions totaling $27m.

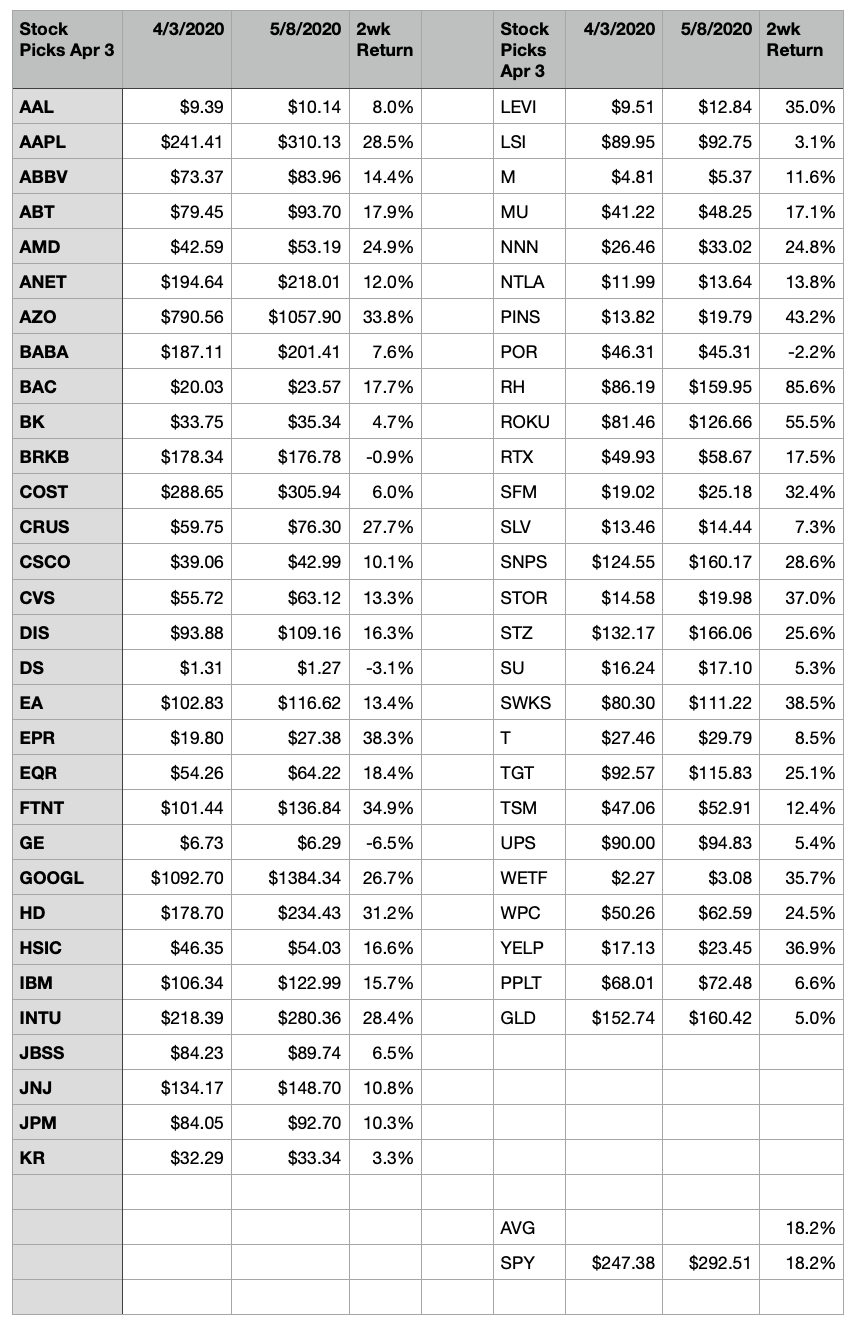

I’m sure if I searched I could find other examples of huge bets against the market. Given the fear caused by the pandemic, and the obvious negative effect it is going to cause on the world economies, a bet on the market failing seems like a safe one. However, my thought is that any bet on a failing market should be truly a hedge in this time of uncertainty and act to cushion the loss in value of a net long position. By being long on solid companies and adding a hedge against the entire market dropping, hedge fund managers should be able to sleep better at night.

My thoughts on where the stock market is going is all of the above. It will drop due to the increasing costs of the pandemic, it will rise due to the monetary and governmental stimulus, and it will stay the same due to the balance of these two. There are a set of universes for each of these three scenarios and I would like to plan so that my portfolio stays roughly the same in each of these cases. For bonds, I like floating over fixed, shorter over longer, and treasuries over non-treasuries. For real estate, I like residential over commercial. For equities, I like American over non-American – although the stronger dollar is going to be a weight on American companies. For currencies, I like the Dollar over the Euro and Yuan and the Yen over the Dollar. For precious metals, I like Silver over Gold. There is a high likelihood that one or more fiat currencies experiences hyper inflation and the Dollar is not immune.