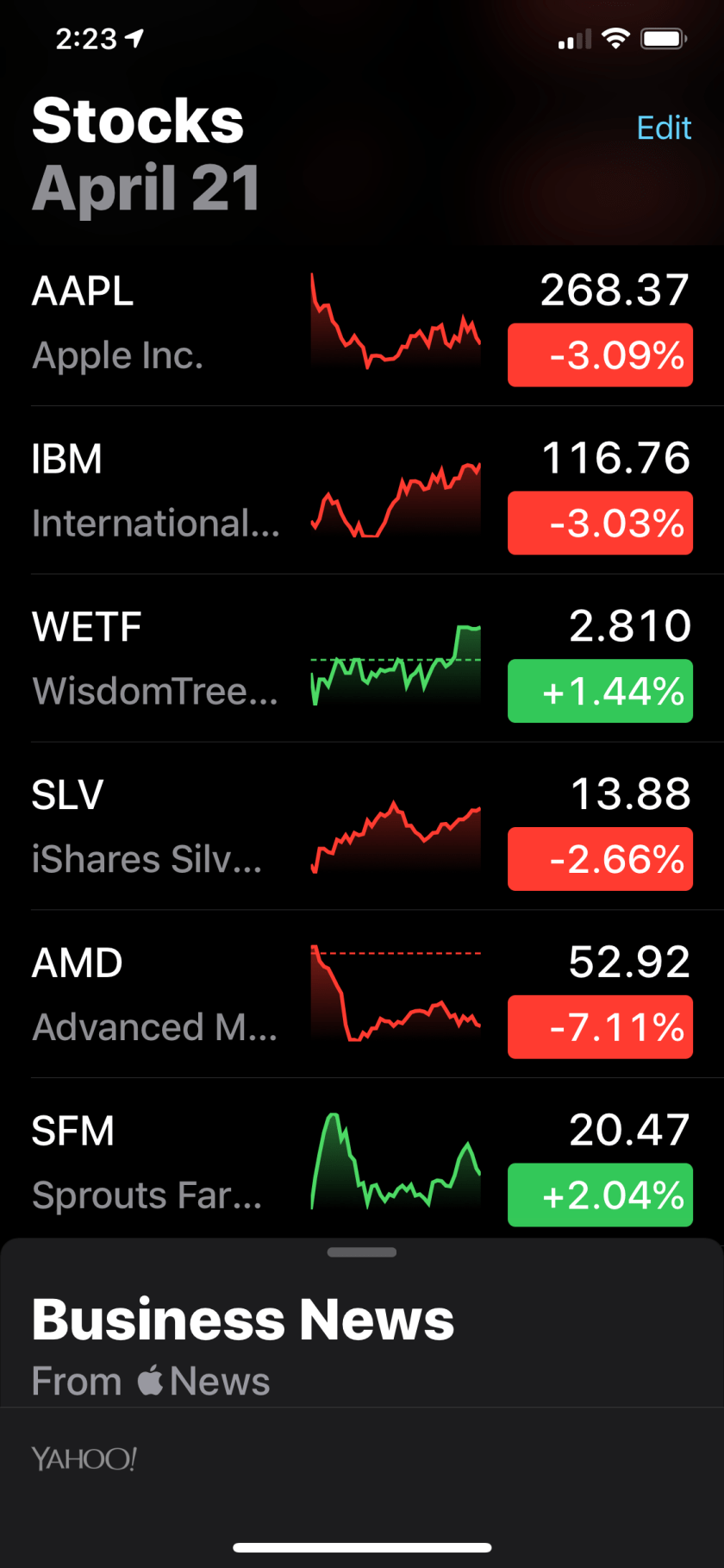

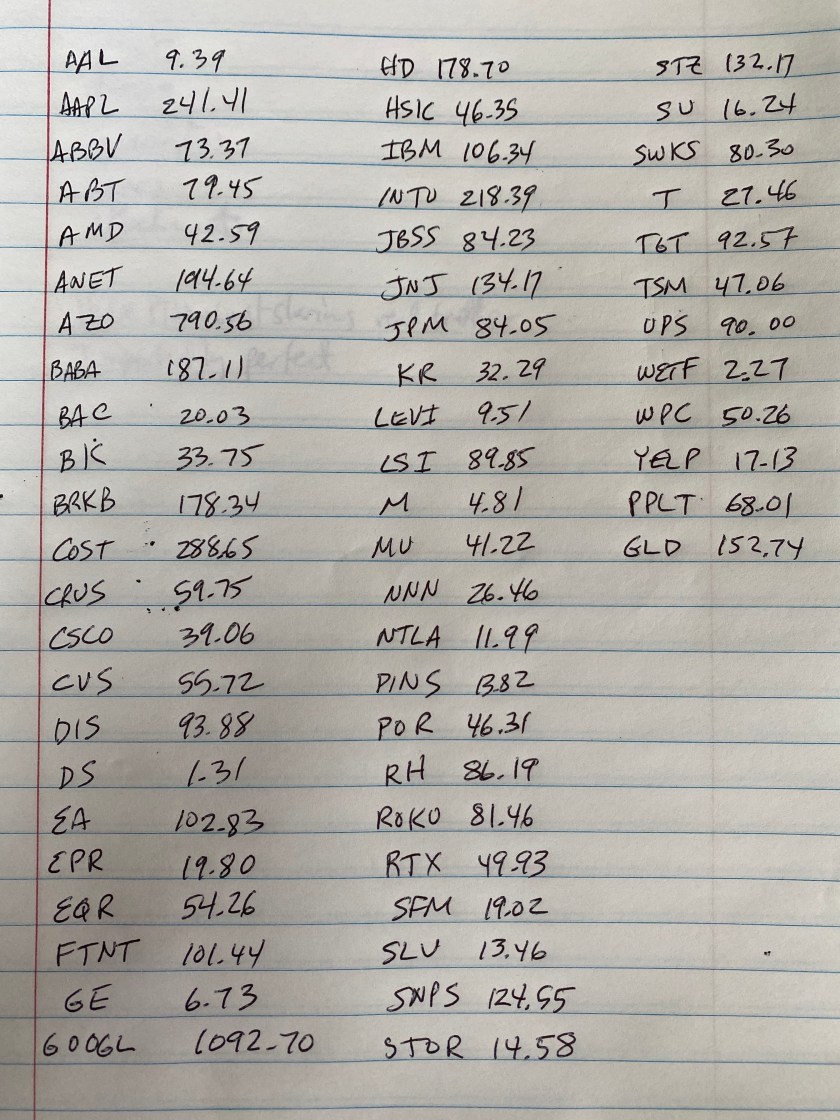

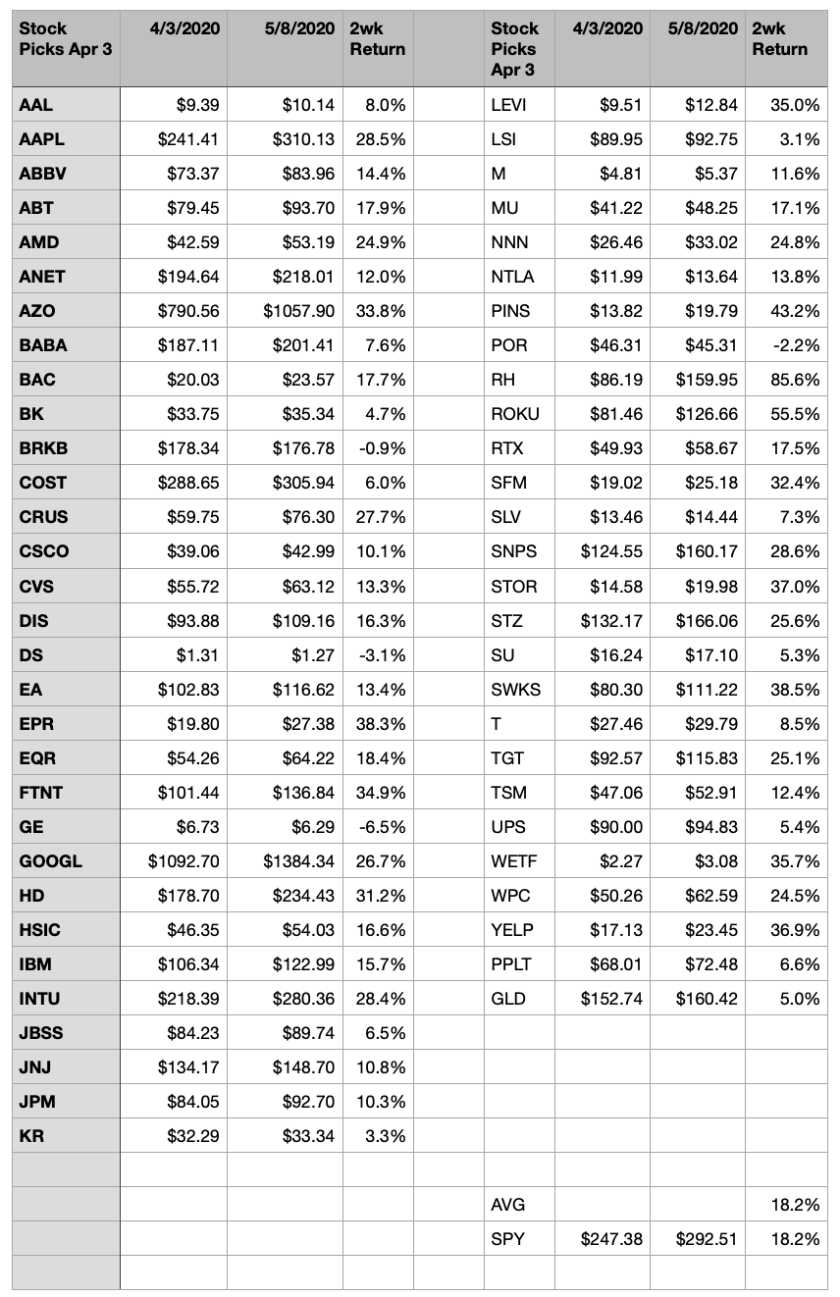

In 20200403F-05u Days 94-96: Long Stock Picks for June 8th and Beyond, I listed some stocks I purchased on that day. I just checked the return of the stock picks and it matched the S&P500 over the last 2 weeks, exactly, at 18.2%. This compares with up 15% 3 weeks ago.

I am a bit surprised that these long picks so closely matched the SPY. With 500 stocks, the SPY provides better diversification. I prefer to be a bit more conscious of the stocks I am picking and don’t want to blindly invest in an index.

For some reason, I started looking at the current price of the S&P 500 of $2929.80 and looked back to when it was about this price in the past. On Oct 4, 2019, S&P 500 closed at $2951.01. Much more synchronistically, the S&P 500 hit a local top of $2925.51 on Oct 3, 2018. Over the next 3 months from that date, the S&P 500 dropped 17% to $2447.89. The Oct 3, 2018 date is synchronistic to me because I referred back to it in AAPL Stock Prediction for Oct 3, 2019, in which I noted:

On Oct 3, 2018, AAPL hit an all time high of $233.47 and today it is down over 20% from that high, opening at $178.37. Could I surf to a universe where APPL stock is up over 25% from today by Oct 3, 2019? In that universe, AAPL would be above it’s all time high price of $233.47. While I can imagine how I could increase my odds of that universe, I do not feel a calling to do so due to the limited influence I believe I have on that event. So, I’m left with a sense based primarily on wishful thinking that AAPL stock will hit a new all time high before Oct 3, 2019.

The AAPL stock prediction was close. AAPL closed at $220.83 on Oct 3, 2019 and a week later set a new high of $236.21 on Oct 11, 2019. On Mar 20, 2020, AAPL hit a year low of $229.24.

If it’s synchronistic, then there must be some meaning to it. The meaning that I’m feeling is that the world is at an inflection point and something unexpected is about to happen.